Meet Adesh,

your go-to licensed independent insurance broker!

With many years of prior experience in the accounting profession, Adesh knows the importance of attention to detail and keeping costs under control. Now, as an independent insurance broker, Adesh applies this expertise to help clients find the best possible deals on Life, Health, and Medicare Insurance.

As a broker, Adesh is not tied to a specific company therefore, he will always put your needs first. He has access to multiple carriers and can shop to find you the best price. His services are also at no cost to you. This is because brokers receive commissions from the insurance companies and those companies are not allowed to increase premiums when a broker is used.

If you’re ready to have someone in your corner, who is knowledgeable of options you may not be aware of, and who will work to find you the best possible deal, look no further than Adesh, your trusted independent insurance broker.

Licensed In Multiple States

Alabama

Florida

Georgia

Michigan

New York

Ohio

South Carolina

Texas

Virginia

Frequently Asked Questions...

What is Medicare?

Medicare is the United States’ federal health insurance program for people who are 65 or older. It is also available for certain people younger than 65 with disabilities or people with End-Stage Renal Disease. There are several parts to Medicare that contain different coverage.

What are Medicare Advantage Plans?

A Medicare Advantage Plan is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. Most Medicare Advantage Plans include drug coverage (Part D). In most cases, you’ll need to use health care providers who participate in the plan’s network. These plans set a limit on what you’ll have to pay out-of-pocket each year for covered services. Some plans offer non-emergency coverage out of network, but typically at a higher cost. In many cases, you may need to get approval from your plan before it covers certain drugs or services. Remember, you must use the card from your Medicare Advantage Plan to get your Medicare-covered services. Keep your red, white, and blue Medicare card in a safe place because you might need it later. If you join a Medicare Advantage Plan, you’ll still have Medicare, but you’ll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare.

What are the different types of Medicare Advantage Plans?

• Health Maintenance Organization (HMO)

• HMO Point-of-Service (HMO-POS)

• Medical Savings Account (MSA)

• Preferred Provider Organization (PPO)

• Private Fee-for-Service (PFFS)

• Special Needs Plan (SNP)

What do Medicare Advantage Plans cover?

Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding clinical trials (clinical research studies), hospice services, and, for a temporary time, some new benefits that come from legislation or national coverage determinations. Be sure to contact your plan if you have questions about covered services. Plans may offer some extra benefits With a Medicare Advantage Plan, you may have coverage for things Original Medicare doesn’t cover, like fitness programs (gym memberships or discounts) and some vision, hearing, and dental services (like routine checkups or cleanings). Plans can also choose to cover even more benefits. For example, some plans may offer coverage for services like transportation to doctor visits, over-the-counter drugs that Part D doesn’t cover, and services that promote your health and wellness. Check with the plan before you join to see what benefits it offers, and if there are any limitations. Plans can also tailor their benefit packages to offer additional benefits to certain chronically ill enrollees. These packages will provide benefits customized to treat specific conditions. Although you can check with a Medicare Advantage plan before you join to see if they offer these benefit packages, you’ll need to wait until you join the plan to see if you qualify.

How does Medicare Supplement Insurance (Medigap) work?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. Medicare Supplement Insurance (Medigap) policies sold by private companies can help pay some of the remaining health care costs for covered services and supplies, like copayments, coinsurance, and deductibles. Some Medigap policies also offer coverage for services that Original Medicare doesn’t cover, like medical care when you travel outside the U.S. Generally, Medigap doesn’t cover long-term care (like care in a nursing home), vision or dental services, hearing aids, eyeglasses, or private-duty nursing.Medigap plans are standardized Medigap must follow federal and state laws designed to protect you, and they must be clearly identified as “Medicare Supplement Insurance.” Insurance companies can sell you only a “standardized” plan, identified in most states as plans A – D, F, G, and K – N. All plans offer the same basic benefits, but some offer additional benefits so you can choose which one meets your needs. In Massachusetts, Minnesota, and Wisconsin, Medigap plans are standardized in a different way. If you live in one of these states and want more information, visit Medicare.gov/medigap-supplemental-insurance-plans .

Important: Medigap plans sold to people who are new to Medicare on or after January 1, 2020, aren’t allowed to cover the Part B deductible. Because of this, Plans C and F are no longer available to people new to Medicare on or after January 1, 2020. However, if you were eligible for Medicare before January 1, 2020, but not yet enrolled, you may be able to buy Plan C or Plan F. People new to Medicare on or after January 1, 2020, have the right to buy Plans D and G instead of Plans C and F.

Can I have Medigap and a Medicare Advantage Plan?

If you’re in a Medicare Advantage Plan, it’s illegal for anyone to sell you a Medigap policy unless you’re switching back to Original Medicare. If you aren’t planning to drop your Medicare Advantage Plan, and someone tries to sell you a Medigap policy, report it to your State Insurance Department. If you have Medigap and join a Medicare Advantage Plan, you may want to drop Medigap. You can’t use Medigap to pay your Medicare Advantage Plan copayments, deductibles, and premiums because Medicare Advantage Plans provide other protections that Medigap doesn’t.

Important!

If you want to cancel your Medigap policy, contact your insurance company. In most cases, if you drop your Medigap policy to join a Medicare Advantage Plan, you may not be able to get the same policy back, or in some cases, any Medigap policy unless you leave your Medicare Advantage Plan during your trial period.

How does Medicare drug coverage work?

Medicare drug coverage (Part D) helps pay for prescription drugs you need. It’s optional and offered to everyone with Medicare. Even if you don’t take prescription drugs now, consider getting Medicare drug coverage. If you decide not to get it when you’re first eligible, and you don’t have other creditable prescription drug coverage (like drug coverage from an employer or union) or get Extra Help, you’ll likely pay a late enrollment penalty if you join a plan later. Generally, you’ll pay this penalty for as long as you have Medicare drug coverage (see “Medicare & You 2023”, CMS, pages 83–84). To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage. Each plan can vary in cost and specific drugs covered. VisitMedicare.gov/plan-compare to find and compare plans in your area. There are 2 ways to get Medicare drug coverage (Part D):1. Medicare drug plans. These plans add Medicare drug coverage (Part D) to Original Medicare, some Medicare Cost Plans, some Medicare Advantage Private Fee-for-Service plans, and Medicare Advantage Medical Savings Account plans. You must have Part A and/or Part B to join a separate Medicare drug plan.2. Medicare Advantage Plans or other Medicare health plans with drug coverage. You get your Part A, Part B, and Medicare drug coverage (Part D) through these plans. Remember, you must have Part A and Part B to join a Medicare Advantage Plan, and not all Medicare Advantage Plans offer drug coverage. In either case, you must live in the service area of the plan you want to join and be lawfully present in the U.S. Medicare drug plans and Medicare health plans with drug coverage are called “Medicare drug coverage” in the “Medicare & You 2023” handbook.

"Adesh took the time to understand my needs for a Life Insurance policy. I was impressed with the options and service so I referred my family and friends to him."

- Gwen

"Working with Adesh made the process extremely fast and easy. He will go the extra mile for you."

- Jacob

"It was my first time enrolling into a Medicare Advantage plan. He explained how all of it works and got me into a fantastic plan."

- Ram

"Adesh was able to answer all of my questions and get me into an affordable plan to meet my needs.

- Rickey

Adesh Soodeen - The Insurance Desk - All Rights Reserved

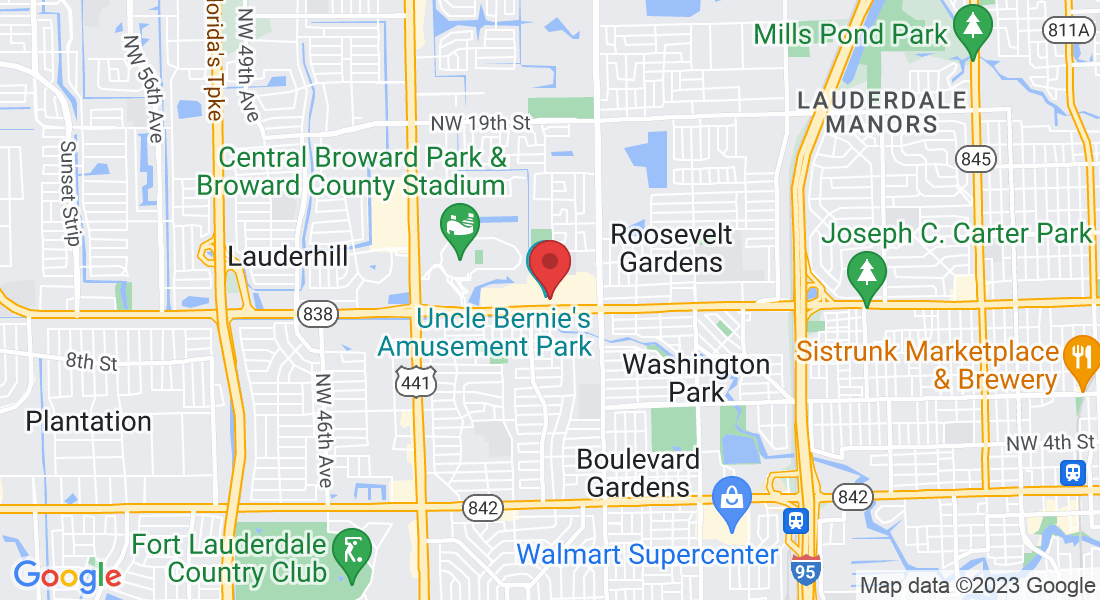

Not affiliated with the U.S. government or federal Medicare program. I do not offer every Medicare plan available in your area. At the time this was published (October 2023), I represent five organizations that offer 64 products in Broward County. Any information I provide is limited to those plans I do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all your options.

The Centers for Medicare & Medicaid Services (CMS) is now requiring that all phone calls concerning enrollment between Medicare beneficiaries (you) and insurance companies, and their agents (me) be recorded.